Budget

Budget

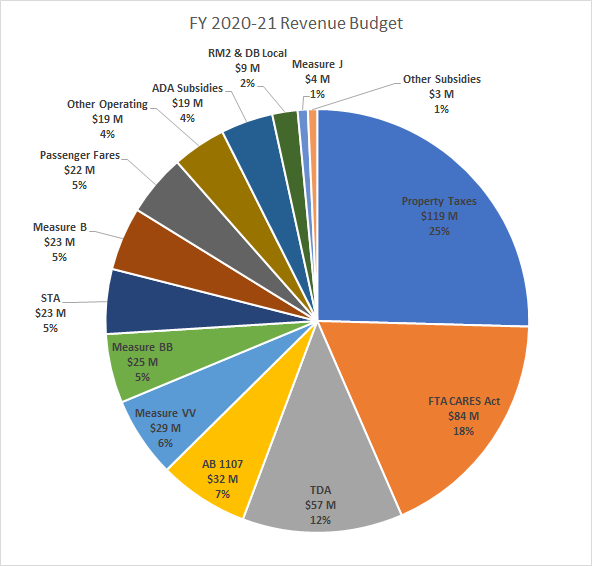

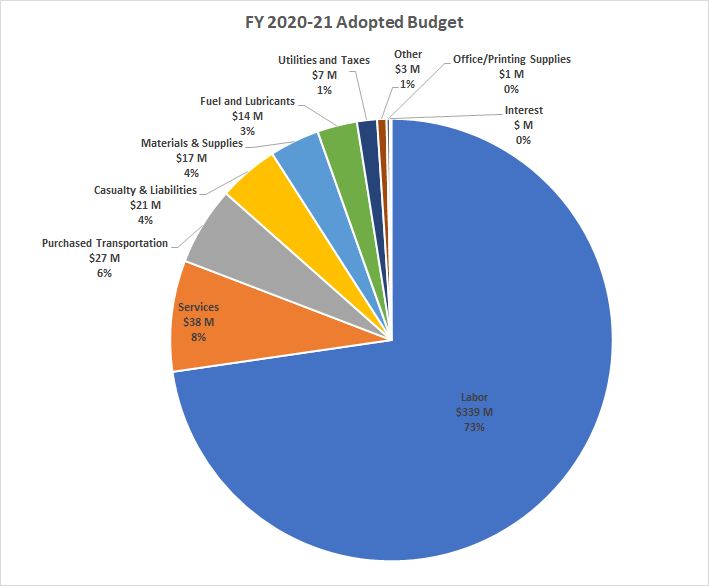

Our adopted operating budget is balanced with the revenue budget at $564.7 million and use of $41.5 million from reserves for fiscal year 2025-2026 (total $606.3 million), up slightly from the $605.8 million previous year. Our funding comes from a variety of sources, including federal, local, regional, and state funds. Bus fares, the most visible source of income, are projected to be 7% of AC Transit operating revenues, down from 12.6% in FY 2019-20. Each revenue source is described below.

National Transit Database Reports

AC Transit’s National Transit Database (NTD) agency profiles for recent fiscal years are provided below.

These include charts summarizing finance, fleet and service information.

Notes on Revenue Sources

Federal Transit Administration (FTA) Funding: Funds for urban mass transit are available from the FTA to qualified transit authorities pursuant to procedures set forth in the Fixing America’s Surface Transportation (FAST) Act. The FAST Act was enacted in December 2015 to further several important goals, including safety, state of good repair, performance, and program efficiency. The process of obtaining federal capital and operating assistance is initiated by a recipient designated by state and local officials, and by publicly owned operators of mass transportation services. The Metropolitan Transportation Commission (MTC), as the designated recipient for the nine county Bay Area, prepares and submits a regional program of projects to the FTA for approval. Federal grants can generally reimburse 80% of the cost of capital programs and a portion of operating expenses to improve or continue mass transportation service. Operating assistance from the FTA can include funding for preventive maintenance and for ADA Complimentary Paratransit Service.

Effective March 27, 2020, FTA allocated $25 billion to eligible transit operators through the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This funding is included in the AC Transit’s FY 19-20 and FY 20-21 Operating Budgets. The Coronavirus Response and Relief Supplemental Appropriations Act of 2021 (CRRSAA) includes $14 billion in supplemental appropriations allocated to support the transit industry during the COVID-19 public health emergency and is included in the FY 2021-22 Operating Budget.

State Sources

Transportation Development Act (TDA): AC Transit receives an allocation of sales tax revenue under the California Transportation Development Act of 1971, as amended, under which receipts from a 0.25% of the state sales tax are reserved for transportation purposes. The Local Transportation Fund (LTF), which was established in 1976, is used for the deposit of TDA revenues collected by the State Board of Equalization within each respective county. The TDA funds in the LTF are apportioned among individual transportation service entities within each county designated as local or regional transportation planning entities. The funds are available for operating assistance in amounts of up to 50% of the operating budget of any individual transportation service entity, after deduction of federal grants and provided that certain TDA criteria are met.

State Transportation Assistance (STA): State Transportation Assistance revenues comes from sales taxes on gasoline and diesel fuel. The STA Program provides funds for public transit operations and for regional transit projects. STA funds are allocated to the region based upon two factors: (1) 50% based on population and (2) 50% based on fare revenues from the prior fiscal year. The revenue share of the funds goes directly to operators, and the population share of the funds is distributed by MTC to a variety of public transit operation programs. Senate Bill 1 (2017) provided a significant funding increase to the STA program.

Senate Bill 1 (SB1): Also known as the Road Repair and Accountability Act of 2017, Senate Bill 1 is a statewide measure to fund transportation infrastructure and transportation services operations. Funded by a tax on fuel, this bill augments existing (STA) operating funding and provides new capital funding sources (State of Good Repair and Local Partnership Program) that AC Transit is eligible for.

Low Carbon Transit Operations Program (LCTOP): The LCTOP provides operating and capital assistance for transit agencies to reduce greenhouse gas emission and improve mobility, with a priority on serving disadvantaged communities.

Local Sources

Assembly Bill 1107 (AB1107): The State Legislature passed Assembly Bill 1107 in 1977, which provides for a 0.5% sales tax for transit purposes in Alameda County, Contra Costa County and the City and County of San Francisco. Of this tax, 75% of the proceeds are allocated to BART and the remaining 25% is administered by the MTC and is split equally between AC Transit and the San Francisco Municipal Transportation Agency.

Alameda County Measure B and Measure BB: Measure B was approved in 1986 and reauthorized in 2000 and authorizes a 0.5% sales tax throughout Alameda County for transportation purposes. The tax revenues fund a balance of mass transit and road improvements and operation. The priorities of the measure are to expand mass transit, improve highway infrastructure, improve local streets and roads, improve bike and pedestrian safety, and to expand special transportation for seniors and people with disabilities. Measure BB was approved by the voters in November 2014. Measure BB is a 0.5% sales tax on top of the existing Measure B, and extends the sales taxes until 2045.

Contra Costa County Measure C and Measure J: Contra Costa voters approved measure J in November 2004 as a 25-year extension of the county wide 0.5% retail sales tax. Measure J became effective in April 2009 upon the expiration of the prior Measure C and continues through March 2034.

Property Taxes – General Property Tax in Alameda County and Contra Costa County: Taxes are levied by Alameda and Contra Costa Counties each Fiscal Year as of the preceding January 1 on taxable real and personal property situated within the District. AC Transit receives a portion of property tax receipts.

Parcel Taxes – Measure VV: In November 2008, the voters within Special Transit Service District 1 approved Measure VV, which superseded the Measure BB parcel tax. Measure VV increased the amount of the parcel tax to $96 per year. The tax became effective on July 1, 2009 and terminates on June 30, 2019. Special Transit Service District 1 covers the majority of AC Transit’s service area extends from San Pablo Bay to Hayward, including the cities of Richmond, San Pablo, El Cerrito, Albany, Berkeley, Emeryville, Oakland, Piedmont, Alameda, San Leandro, Hayward, and the unincorporated areas of Ashland, Castro Valley, Cherryland, El Sobrante, Kensington, and San Lorenzo. Measure C1 was approved on November 2016 and extends the annual parcel tax for 20 years beginning July 2019.

Regional Measure 2 (RM2): Approved by voters in March 2004, RM2 allocates additional bridge toll revenues for various transportation projects and operations within the region that have been determined to reduce congestion or to make improvements to travel in the toll bridge corridors.

Regional Measure 3 (RM3): To help solve the Bay Area’s growing congestion problems, MTC worked with the state Legislature to authorize a ballot measure that would finance a comprehensive suite of highway and transit improvements through an increase tolls on the region’s seven state-owned toll bridges. Senate Bill 595 (authored by Sen. Jim Beall of San Jose) was passed by the Legislature and signed into law in fall 2017.